The Ultimate Guide to Invoice Automation for Businesses

Admin

Admin Digital Transformation

Digital Transformation Mar 03, 2025

Mar 03, 2025

Table of Content

Managing invoices has proven to be a very tedious task and as far as the nightmare goes, is indeed related to bears for your accounts payable team. Everything from data entry to sending invoices and monitoring payments is very great for slowing down the cash flow and incurring administrative overhead.

Automated invoicing reduces manual intervention and thus eliminates all scope for errors, leading to quicker payments. Invoice process automation software tends to clear the path to make billing practices simpler. With this compelling advantage, firms stand to save considerable time, improve their level of accuracy, and achieve all-around financial management.

This guide will explore automation and how AI invoice automation can improve revenue maximization for your business while at the same time making it more efficient.

What is Invoice Automation?

Invoice automation is the mechanism of using accounting software to make the development, delivery, and handling of invoices easier. This blocks the need for human data entry, resulting in reduced errors and an overall increase in efficiency in financial operations.

With invoice automation, referred to as electronic invoicing or e-invoicing, companies would integrate the digital tool with their enterprise resource planning (ERP) system. The AI Invoice Processing Software extracts invoice data, records it in the accounting system, and automates approvals as well as payments. This hands-free approach brings the necessary financial workflows while allowing the organization to engage in other strategic works while ensuring the accuracy and speed at which they are processed.

Invoice automation improves vendor relationships, cash flow management, and enhancement of cross-department collaboration—which are all done without losing control of the companies over their finances.

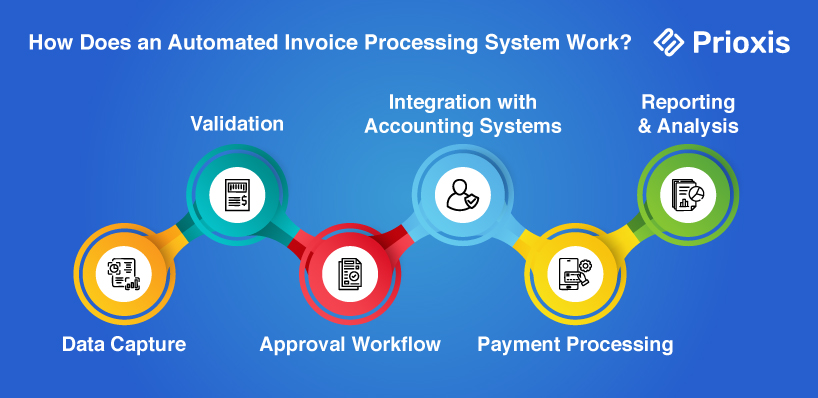

How Does an Automated Invoice Processing System Work?

This automated invoice processing Automation system brings simplicity and speed to the invoicing workflow, with less manual handling, fewer errors, and more efficiency for the accounts payable process. This system is built around a structured approach with some key steps:

1. Data Capture

The invoices are received in electronic form and scanned into a machine using Optical Character Recognition, after which they produce data corresponding to invoice numbers, invoice dates, vendor names, and amounts to be paid. All the mandatory information is retrieved from the respective invoices.

2. Validation

After being extracted, the data is validated against a set of business rules to ensure they are accurate and reasonable. In the same instance, the system looks through its databases for duplicate invoices, checks tax computation units, and ensures conformity with the mutually agreed payment terms to avert conflicts before they get blown out of all proportions.

3. Approval Workflow

Invoices will be given approval workflows in an automated manner based on the rules established. Approval members will be notified about the pending invoices and will be able to review and approve or decline them electronically. This eliminates bottlenecks in the approval process.

4. Integration with Accounting Systems

The validated invoice data is integrated seamlessly with whichever accounting software system or Enterprise Resource Planning (ERP) system. Such transfer of data happens without the manual entry of information, resulting in fewer errors while ensuring timely updates of financial records.

5. Payment Processing

Invoices are then processed for payment after being approved, with processing done according to pre-established schedules and the vendor's preference in making payments. Electronic payments can be made through wire transfers, digital wallets, or automated check issuance, thus ensuring timeliness.

6. Reporting and Analysis

An automated invoice processing system provides real-time insight into the status of invoices, outstanding payments, and overall financial performance. Reporting tools are available for businesses to analyze processing efficiencies, optimize cash flows, and enhance decision-making.

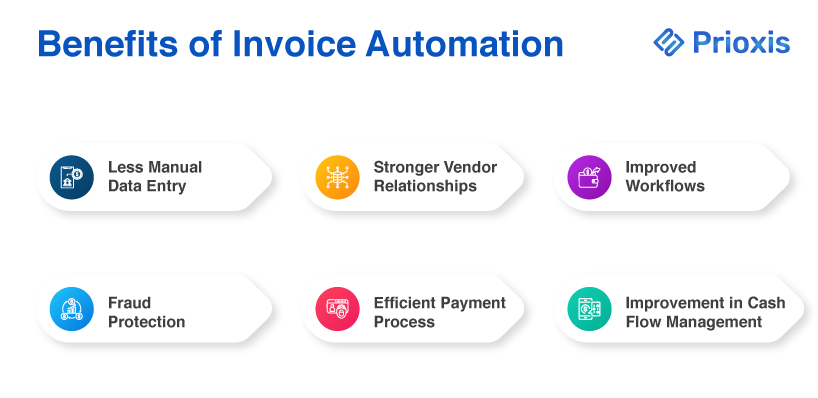

Benefits of Invoice Automation

Implementing an invoice automation program streamlines the financial functioning so that efficiency, correct functioning, and workflow are all enhanced. The Major Benefits of Automated Invoice Processing include:

- Less Manual Data Entry - Reducing monotonous keying of information not only minimizes errors but also helps companies channel their resources into strategic work.

- Stronger Vendor Relationships - Timely and accurate payment builds credibility; this also forms the basis for taking advantage of early payment discounts.

- Improved Workflows - Centralized invoice supervision enhances visibility, thereby allowing for effective processing and analysis of invoices.

- Fraud Protection - With automated systems, any exceptions that arise will be able to detect potential financial fraud and thus support compliance with auditing.

- An Efficient Payment Process - Scheduled payments increase vendor trust and lessen the load on small firms.

- Improvement in Cash Flow Management - Automation puts a bar on overdrafts, reminds you to avoid late fees, and protects your seamless flow in financial operation.

Learn More: What is a Treasury Management System?

How to Implement an Invoice Automation System in Your Business?

A well-structured approach is needed to ensure a smooth transition and maximum efficiency in the implementation of automated invoice processing. Here are the key steps to follow:

1. Assess Current Processes and Define Goals

Evaluate your existing invoice workflow to identify the areas that are not being utilized fully. Have clear goals like a set time for invoice processing, fewer errors, and minor cash flow consequences.

2. Assess the Infrastructure and Training Needs

Determining whether current hardware and software could sustain automation solutions, learning needs can now be identified for possible employee training.

3. Identifying an Appropriate Automating Solution

Make research concerning the budget, size of the business, and operational requirements regarding AI Invoice Processing Software. Choose a system that can perform data capturing, reporting, and scalability.

4. Integrate with Existing Systems

Integrate with other financial tools and ERP to have a smooth mechanism of data flow to eliminate manual data entry and errors, while at the same time effective accounting management.

5. Define Roles and Responsibilities

Defined roles should be assigned to each member of the team in charge of invoice processing, as well as identified communication channels for more effective collaboration.

6. Pilot Test and Full Roll-out

Conduct a pilot test for a limited group to evaluate how the system is working or to find certain loopholes within the system. Modify the system as the feedback suggests and then roll it out to the whole organization.

Traditional vs. Automated Invoice Processing

There are two absolute extremes manual invoice processing and automated.

Traditional Invoice Processing

Here manual means everything finance teams do from data entry to verifying details to managing approvals. Manual invoice processing is time-consuming, error-prone, and subject to constant reviewing. Physical invoices simply add to the fray, increasing the risk of losing documents and the risk of being delayed further.

Automated Invoice Processing

Here, automation deals with repetitive tasks like data capture, validation, and approval workflows with utmost efficiency. It enhances the speed of processing, minimizes chances for error, and ensures that the invoice gets processed appropriately. Automation frees finance teams to spend time on value-adding tasks such as financial analysis instead of getting caught in paperwork.

Challenges in Manual Invoice Processing

Manual processing of invoices has some drawbacks that may compromise operational efficiency and financial accuracy. Some of the main problems are:

1. Time-Consuming Processes

Manual processing of invoices involves much time in entering data, validating, and approving, causing delayed payments and forfeited early payment discounts.

2. High Error Rates

Manual invoice entry is susceptible to human errors like wrong amounts or repetition, leading to financial discrepancies and strained relations with vendors.

3. Higher Processing Costs

Manual processes involve increased labor costs and paper handling and storage charges and hence become less cost-effective than automated solutions.

4. Inability to Provide Visibility and Control

Without a centralized system, it is difficult to track invoice statuses, and hence there is less transparency and control over cash flow and financial planning.

5. Exposure to Fraud

Manual systems can lack strong mechanisms to identify fraudulent invoices, making unauthorized payments and financial losses more likely.

Conclusion

Through the incorporation of invoice automation, the process of invoicing is streamlined, and a complete overhaul of the business is possible. An automation solution that improves efficiency, accuracy, and control over financial management by removing manual errors, cutting down on payment delays, and centralizing financial data.

Are you ready to elevate your invoicing? Empower your business with Prioxis and enjoy seamless, automated financial management!

Get in touch