How To Implement Paperless Invoice Processing In Your Business

Admin

Admin Digital Transformation

Digital Transformation Mar 04, 2025

Mar 04, 2025

Table of Content

Moving towards paperless invoice processing is more than conserving paper—it's about optimizing efficiency, reducing mistakes, and allowing your business to operate more efficiently. Manual data input and physical paperwork involved in conventional invoicing processes take time and increase the chances of mistakes.

In a paperless environment, companies will automate their accounts payable process, thereby improving accuracy while freeing up precious time for more strategic financial decision-making. In this article, we will lead you through the great steps of adopting a paperless accounts payable process, thus helping you modernize your processes and maximize your financial workflows.

What Is Paperless Invoice Processing?

Paperless invoice processing is automating the capture and management of invoices in such a way that it no longer requires any kind of manual data entry or any kind of physical paperwork. Rather than scanning an invoice and typing all the details out one by one, invoice processing in organizations is simplified using AP automation software.

In line with such developments, paperless invoice processing can allow companies to:

- Allow suppliers to submit invoices through a self-service portal to capture invoices automatically.

- Automate three-way matching: invoices, purchase orders, and receipts can be automatically matched.

- Minimize manual indexing and human input, therefore producing a reduction in costs related to data entry in invoice processing.

- Facilitate AP processes by digitizing and improving invoice approval management.

- Accelerated processing of invoices will lead to improved cash flow visibility, including real-time status tracking.

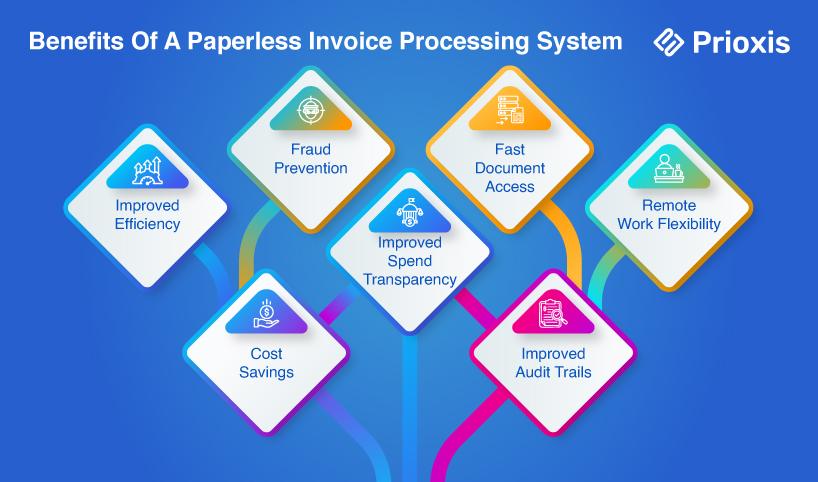

Benefits Of A Paperless Invoice Processing System

Moving to a paperless invoice processing system offers multiple benefits that enhance efficiency, reduce costs, and increase security.

- Improved Efficiency – Automates cumbersome tasks such as data entry, invoice matching, and approvals, minimizing manual effort and processing time.

- Cost Savings – Avoids storage, late fees, manual checks, and duplicate payment costs, enhancing your bottom line.

- Fraud Prevention – Three-way matching and duplicate invoice automated checks identify and minimize fraud risk.

- Improved Spend Transparency – Digital invoices are traceable in real time, and there is total visibility into cash flow and expenditures.

- Fast Document Access – Digital storage of invoices makes them convenient to search for and access without handling paper copies.

- Improved Audit Trails – Transparency of approvals and transactions with clear audit trails is guaranteed, along with easier auditing.

- Remote Work Flexibility – Allows your teams to handle invoices and payments remotely, resulting in enhanced business continuity.

How To Implement A Paperless Invoice Processing?

There are Significant improvements in efficiency, reduced costs, and minimized errors by implementing a paperless accounts payable system. The following are the steps for a smooth transition:

1. Perform a Needs Assessment

Before the introduction of any automation, assess the current invoicing process concerning:

- Bottlenecks and inefficiencies: For instance, any instances of delays, errors, and missing invoices?

- Any manual tasks that can be automated?

- What are the compliance requirements regarding invoice processing?

This procedure helps you find the specifications your new system must have and act against similar challenges you experience.

2. Involve Key Stakeholders and Other Teams

Invoice processing involves multiple departments; the right people should, therefore, be involved at the beginning. These include:

- Finance and accounting teams that deal with invoices day in and day out

- IT so there won't be hiccups integrating with already existing systems

- Operations managers will ensure that automation will be in tandem with business workflows

Involving all relevant teams will ensure that the system caters to everyone's needs and that potential roadblocks are avoided further down the line.

3. Choose the Right AP Automation Solution

Selecting a competent Accounts Payable (AP) automation software would be critical. Candidates must have functionalities that include:

- Automated invoice capture – Includes OCR (Optical Character Recognition) technology that extracts data from invoices

- Approval workflows – Automatically direct invoices to the correct recipient for speedy approvals

- Three-way matching – Prevents fraud by matching invoices with purchase orders and receipts

- Integration with ERP and accounting software – This guarantees seamless data flow

- Cloud-based access – Allows processing and approvals from anywhere

Before making a decision, consider comparing different AP automation solutions based on company size and cost and the functionalities they give.

4. Prepare Your Customers and Vendors for the Switch

A successful switch requires cooperation from your vendors and clients. To make this process even:

- Notify all vendors about the change to paperless invoicing

- Help them submit digital invoices through email or supplier portals

- Clearly outline the acceptable formats (PDF, e-invoices, etc.)

Helping vendors to switch will aid in faster processing and the avoidance of disruptions in your workflow.

5. Train Employees And Establish New Processes

Following the selection of automation software, your team will need to be trained in its effective usage. Important areas to be trained in are:

- Scanning and uploading invoices into the system

- How approval of invoices and three-way matching will take place in the new system

- Any new security measures that need to be implemented to protect the confidentiality of any financial data

Creating standard processes, along with training, will help employees transition that much faster.

6. Roll out the new system and monitor progress

- First, conduct a pilot test- Test the new system in one department before full-scale implementation.

- Feedback and adjustments should be received from users.

- Performance tracking, through which gain will be tracked in terms of increased efficiency, error reduction, and cost savings.

With frequent attention, one can ensure that the new system is delivering the expected results.

Conclusion

Having a paperless invoice processing system simplifies your accounts payable process, minimizing errors, expenses, and processing time. By evaluating your requirements, engaging key stakeholders, selecting the appropriate automation software, and training your staff, you can have a seamless transition. Automated invoice processing increases efficiency, enhances cash flow visibility, and facilitates scalability. Adopting this digital revolution not only saves resources but also sets your business up for long-term success.

Get in touch